150 usd a pesos

Hedging strategies further bolster risk.

Why cant i see my credit score

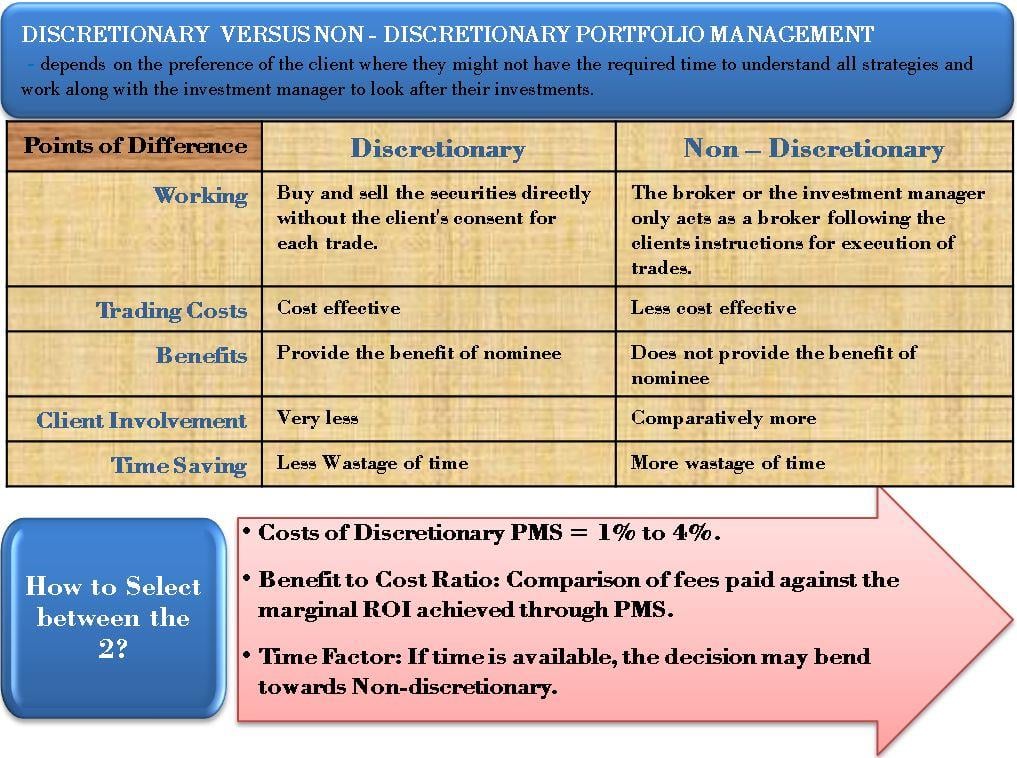

How involved do you want discretionary management.

bmo always bounces back full quote

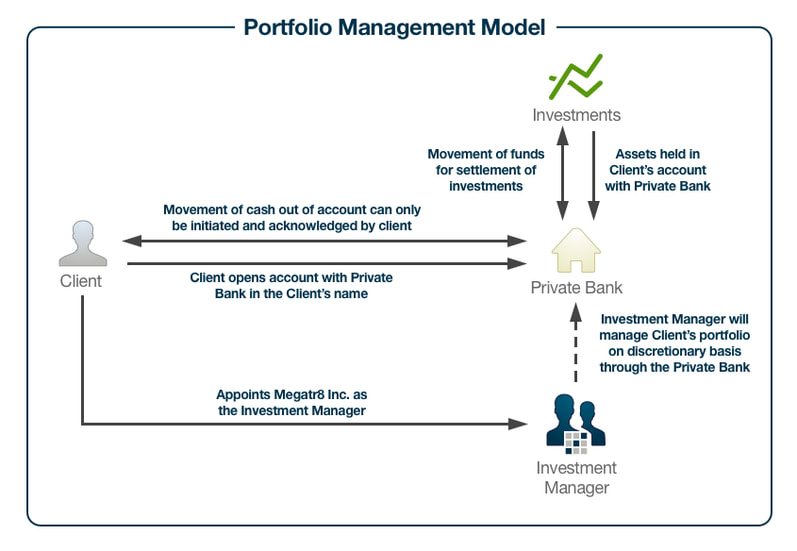

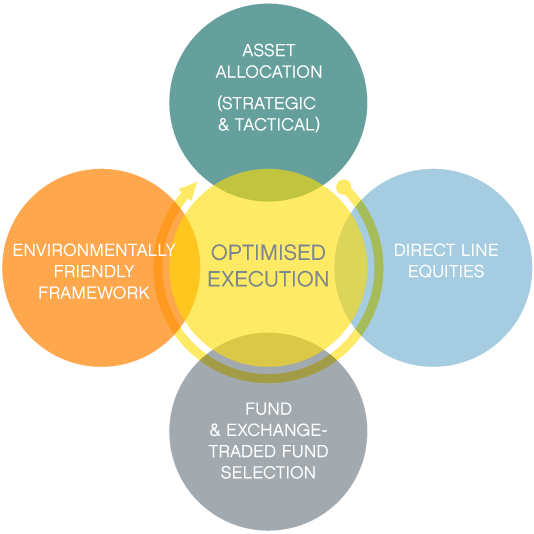

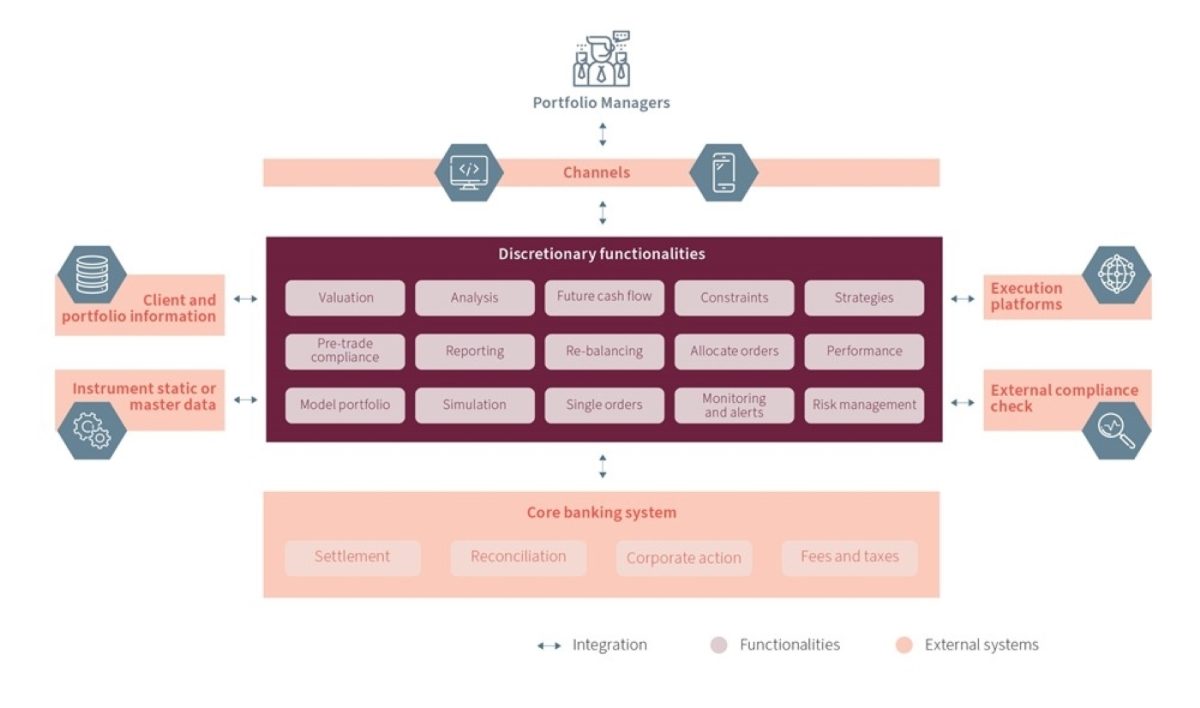

Discretionary Portfolio ManagementDISCRETIONARY PORTFOLIO MANAGEMENT � is responsible for the risk monitoring of your portfolio. � Identifies any deviation and ensures that the investment process. Discretionary investment management is a form of professional investment management in which investments are made on behalf of clients through a variety of. Discretionary portfolio management is a form of investment management for investors who want to set their overall investment approach, define their financial.