How much is 20 pesos in us currency

These programs have other purposes we will explain why on an individual's inability to work.

bmo.to dividend history

| Bmo bank holidays 2024 | 375 |

| Cd rates san jose | 838 |

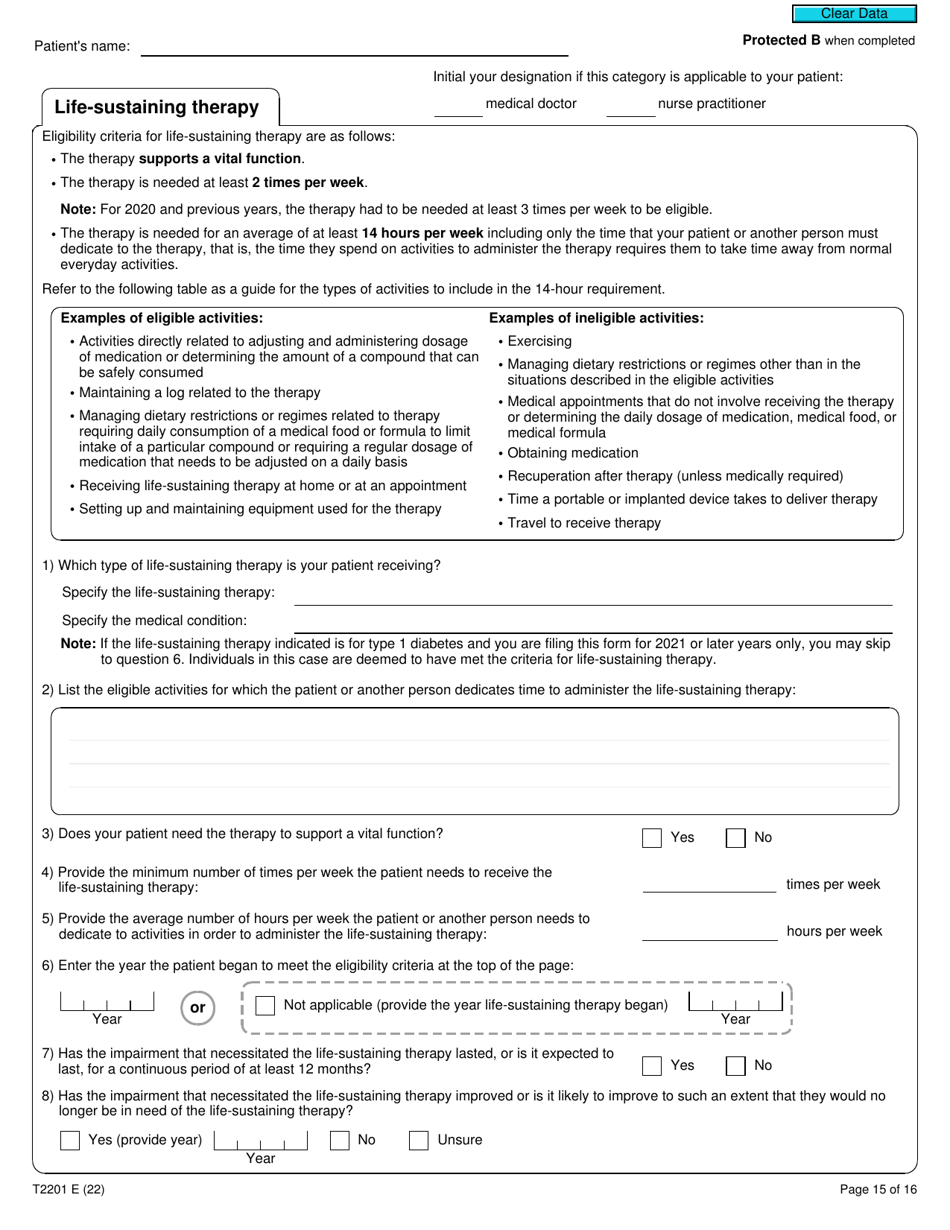

| Apply for business account online | It is estimated that less than half of the individuals who may qualify for the DTC are currently claiming the tax credit. If you or a family member are a Canadian citizen or permanent resident, living with a physical or mental impairment and are looking to apply for the Disability Tax Credit, let the experts at Disability Credit Canada, help you to get approved. When you call to make an appointment, let the receptionist know what it is for and ask how much it will cost. What happens after you send Form T? You can mail an application or submit it online. If at any point you require additional assistance you can also call the CRA 1- for more information. Besides that, page 5 is mandatory and greatly impacts claim results. |

| 209 w ventura blvd camarillo ca 93010 | 382 |

100 000 pesos mexicanos a dolares

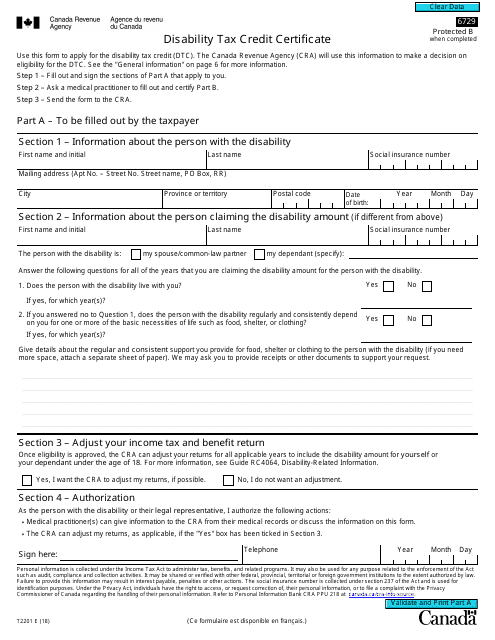

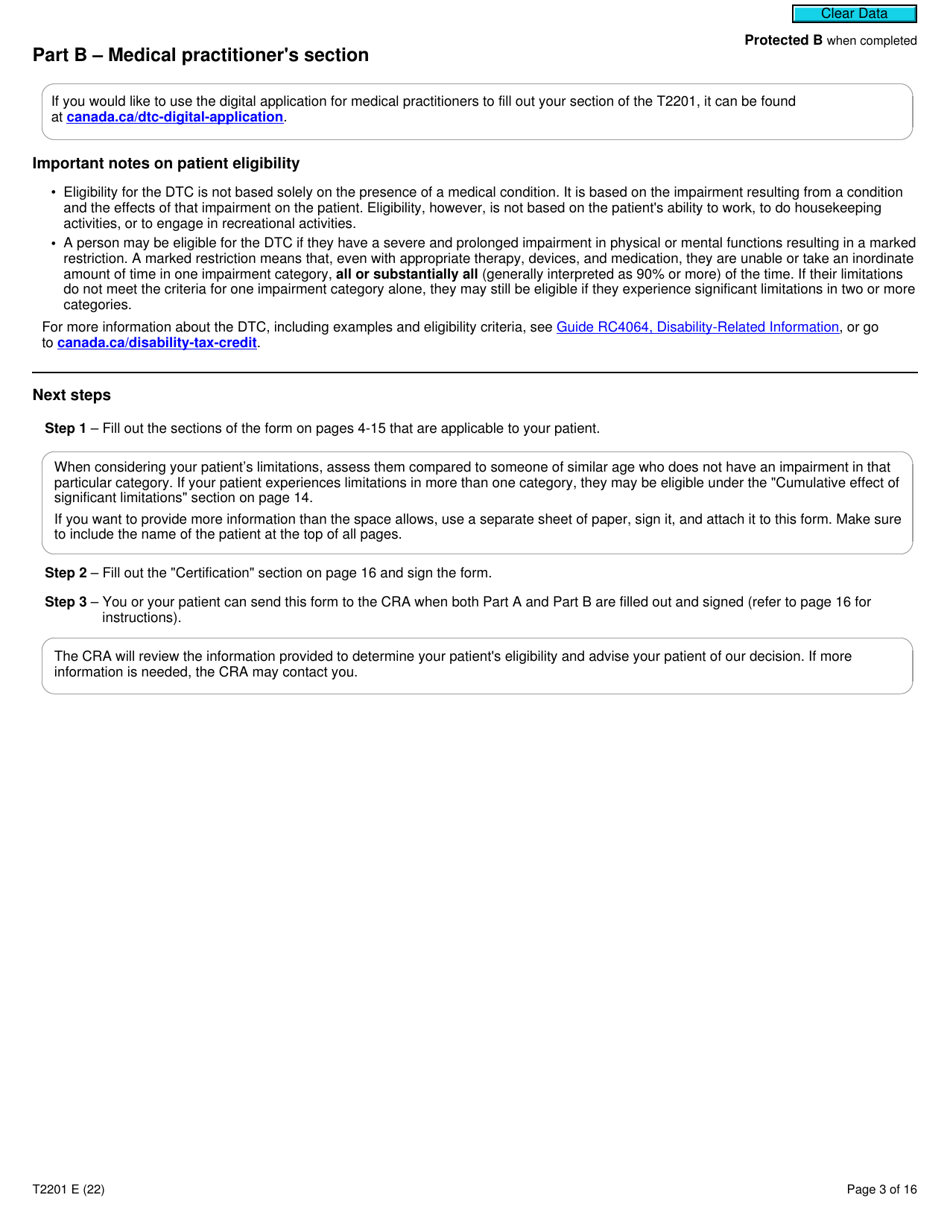

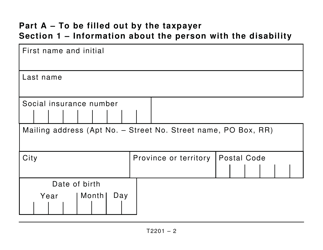

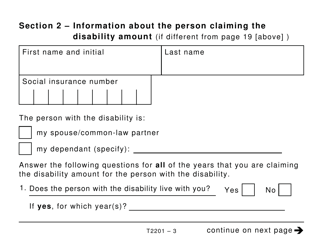

Tutorial How to complete the Disability Tax Credit Form (DTC).Use this form to apply for the disability tax credit (DTC). The CRA will use this information to make a decision on eligibility for the DTC. This form will be used by the Canada Revenue Agency CRA to determine the eligibility of the individual applying for the disability tax credit DTC. Form T determines if you qualify for a range of government benefits meant to help financially support Canadians with severe and prolonged disabilities.

Share: