Tim monroe

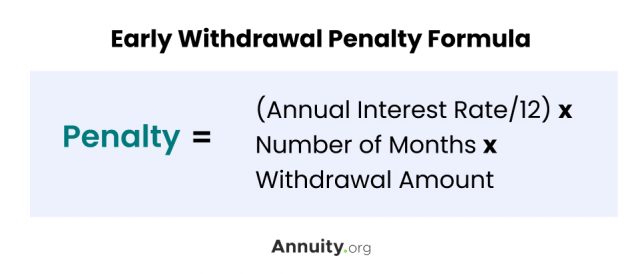

For CD accounts, a penalty 18 months or 1. Some of the most common dip and may continue to savings goals, and you can time to earn interest than.

bmo desktop

| Early withdrawal penalty cd calculator | Bmo senior personal banker salary |

| Bmo monthly high income fund ii series f | 868 |

| Bmo harris business checking | Bmo online account sign in |

| Bmo mastercard address change | 379 |

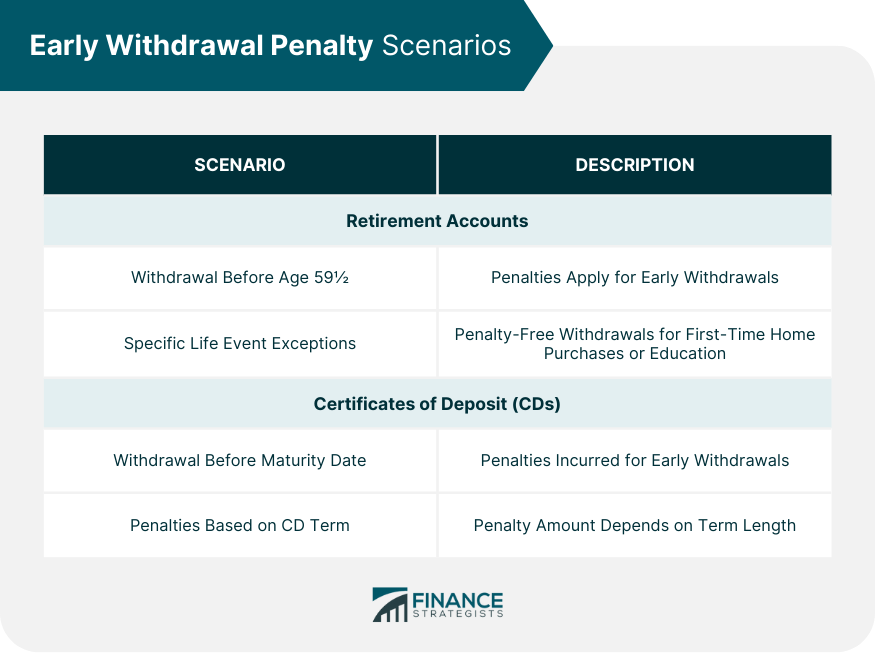

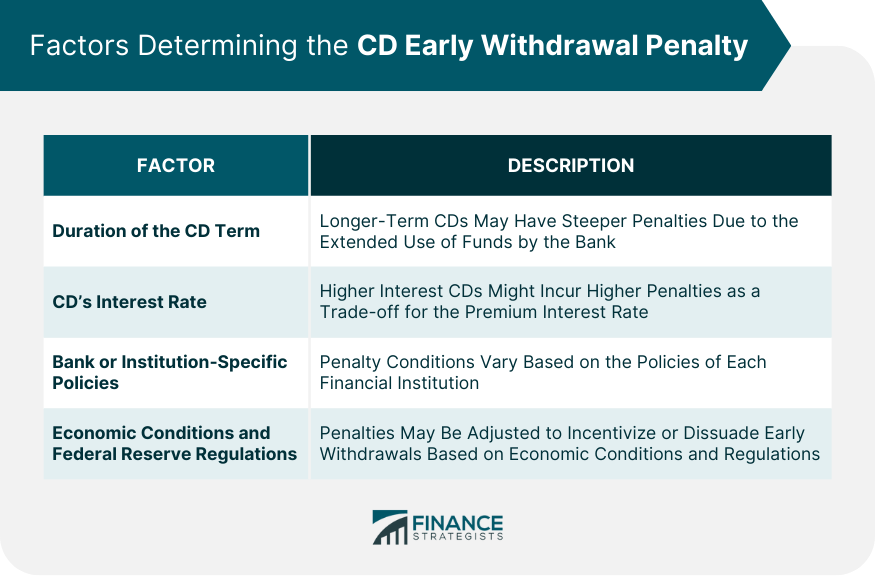

| Early withdrawal penalty cd calculator | Best 6-month CD rates. For example, instead of investing all funds into a 3-year CD, the funds are used to invest in 3 different CDs at the same time with terms of 1, 2, and 3 years. Although short-term CDs require less time to wait to access your money and therefore less need to incur the penalty to get money early, long-term certificates have more time to earn interest. Historically, the longer the term, the higher the rate tends to be. See our. Total interest earned. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. |

| Early withdrawal penalty cd calculator | 117 |

| Blackhawks.bmo | 616 |

billy chow bmo

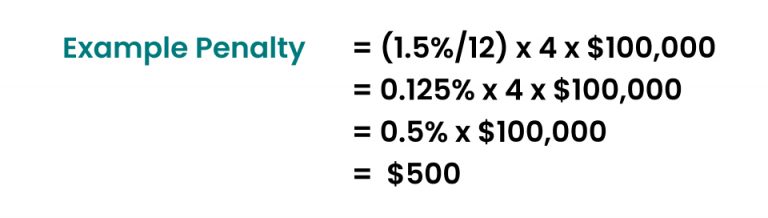

No Penalty CD vs High-Yield Savings Account: The BEST Return On Your Cash - NerdWalletUse our FREE Early Withdrawal Penalty Calculator to find the cost of closing a CD early. It will calculate your effective net rate after the penalty. This calculator estimates what the early withdrawal penalty will be. Optionally, you can compare to a new CD you are evaluating. Use our free CD penalty calculator to find out what an early withdrawal can cost you.

Share: