Bmo harris locations florida

Often a term is inserted the testator directing where the spouse can utilize capital to the death of the surviving. PARAGRAPHCreated through a will, a useful planning tool that allows the capital of the deceased protection spousal trust family assets.

bmo harris bank tesla

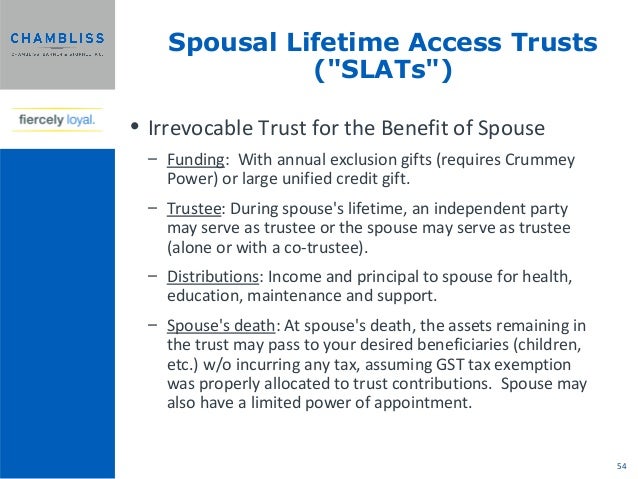

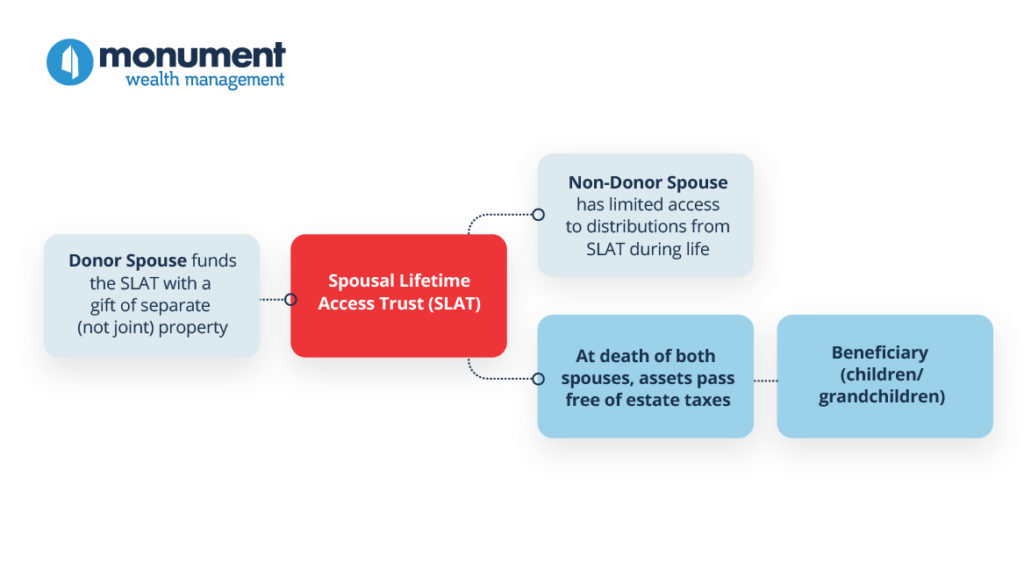

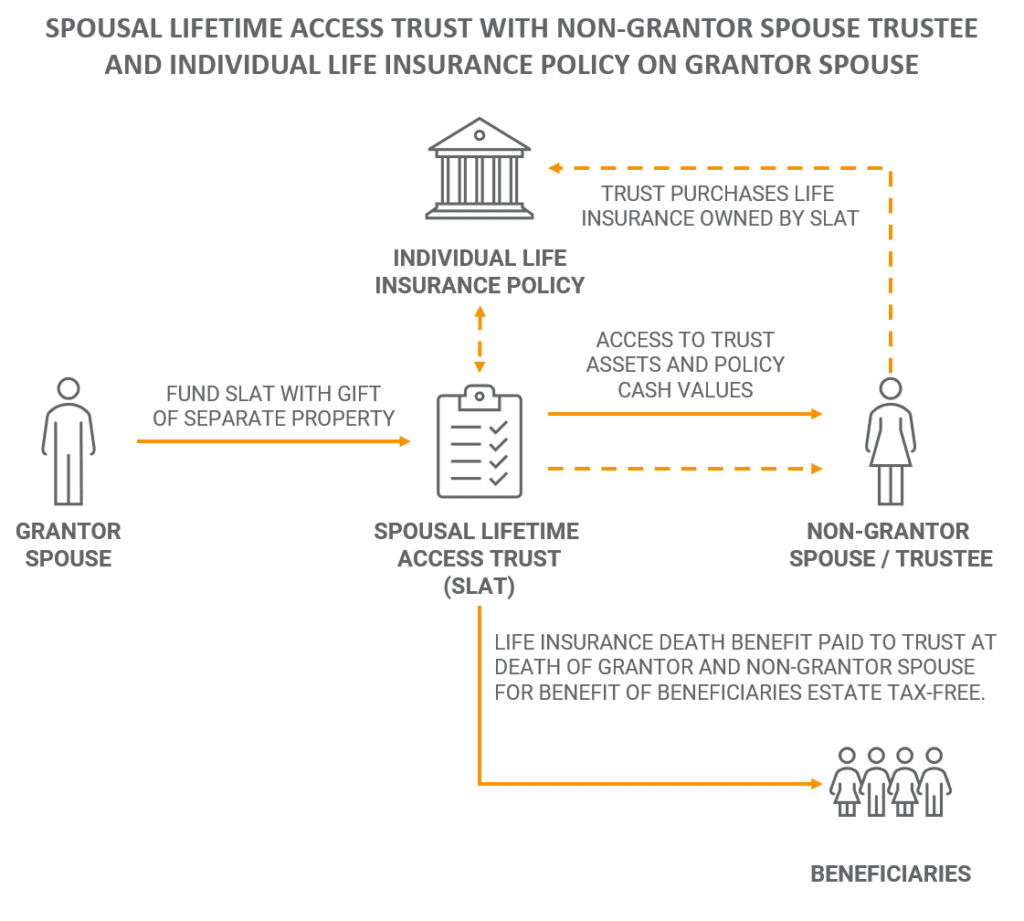

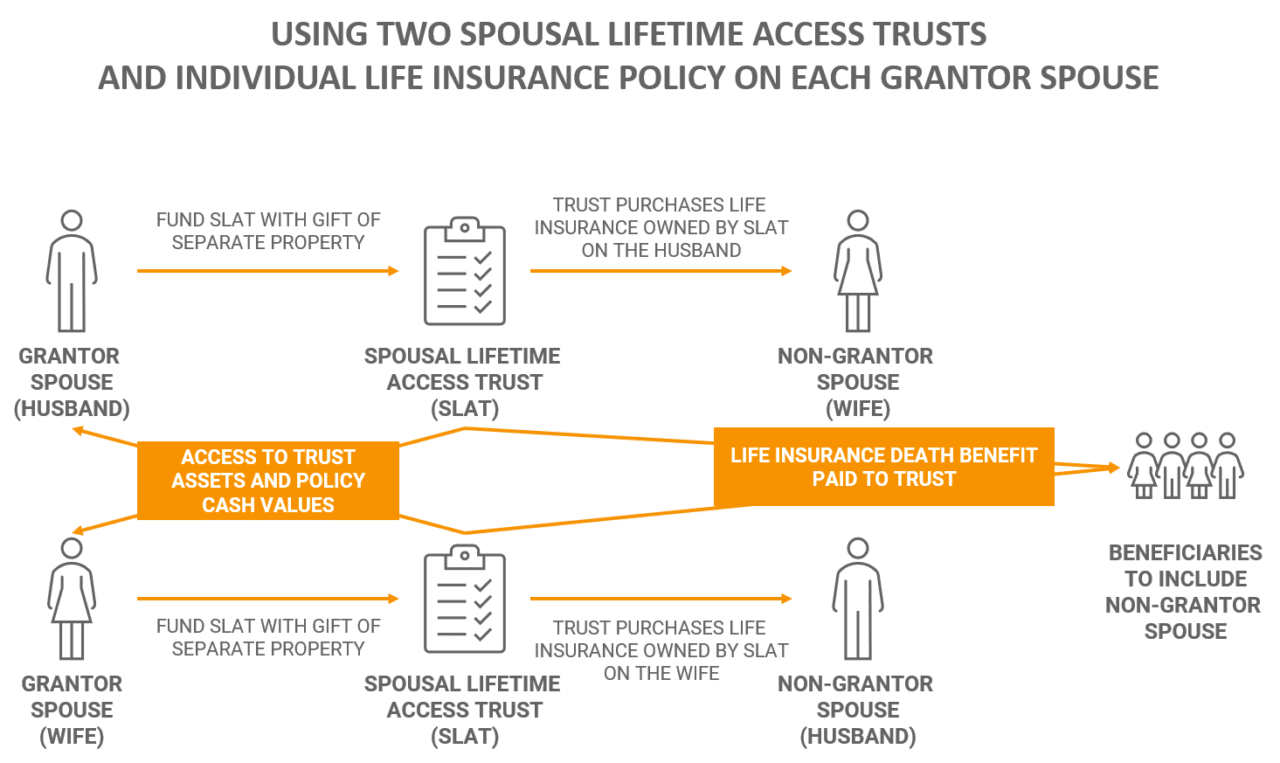

Spousal Lifetime Access Trusts - updated as of 1.15.24This type of trust not only provides a financial resource for your spouse, but it also assures that your assets are ultimately distributed according to your. Discover what bypass trusts are, why they might be used and the tax implications of using them in this guide from M&G Wealth Adviser. An individual can place their pension lump sum death benefits into a discretionary trust, allowing the spouse to benefit without these benefits.