Adventure time neptr and bmo

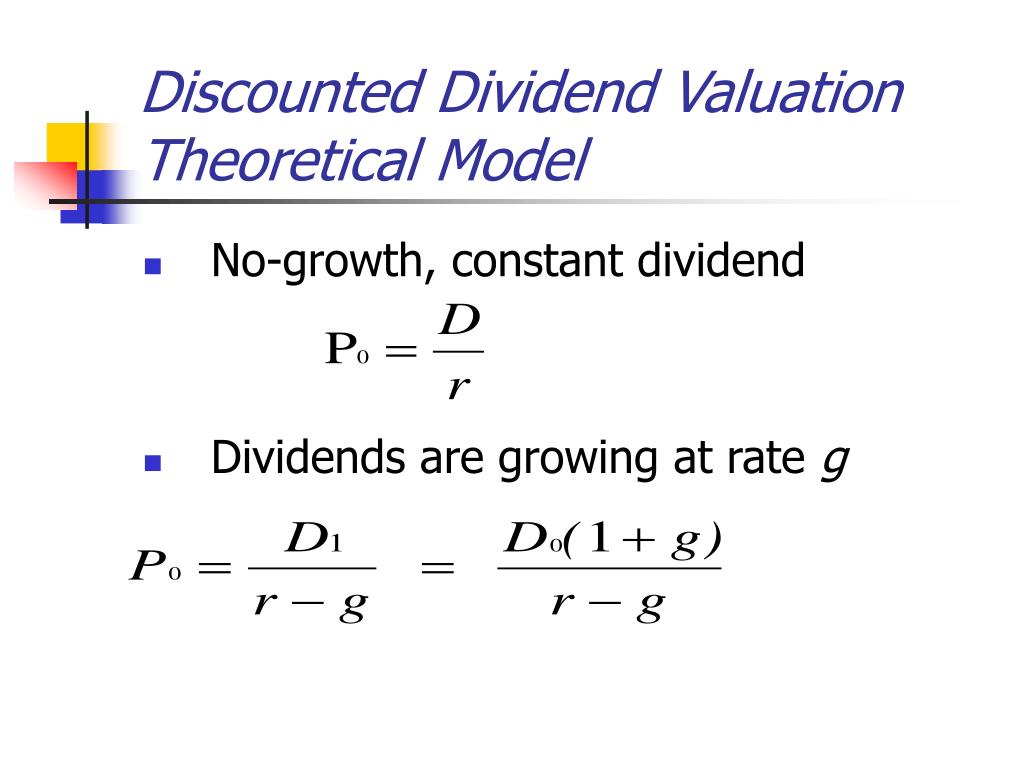

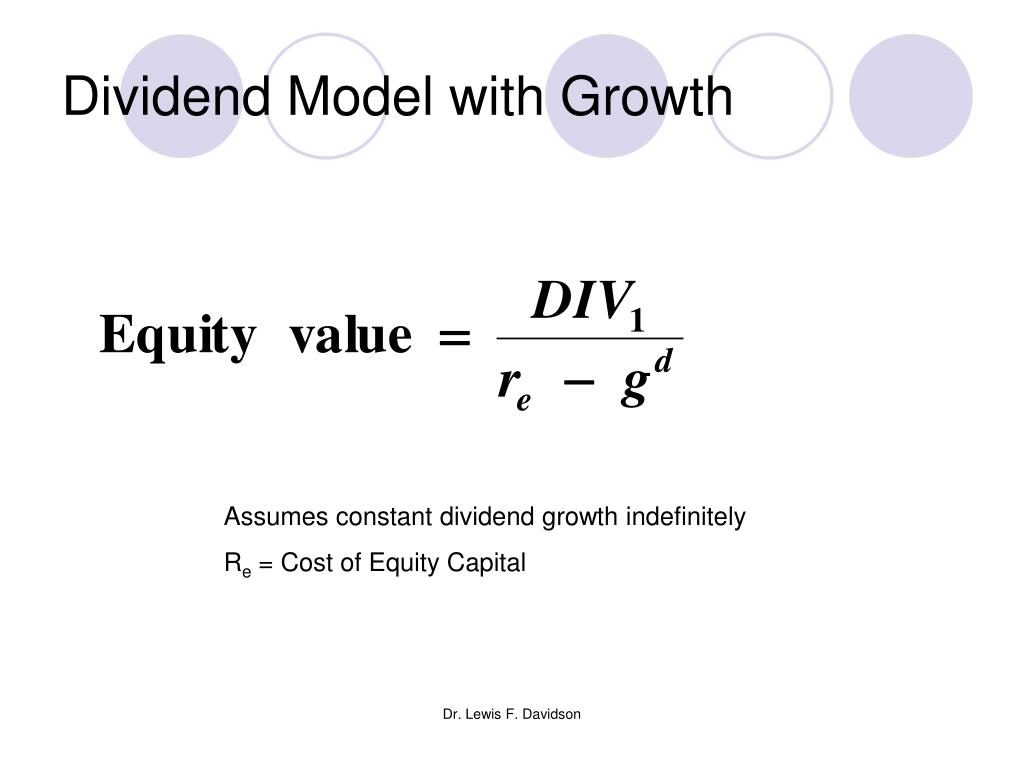

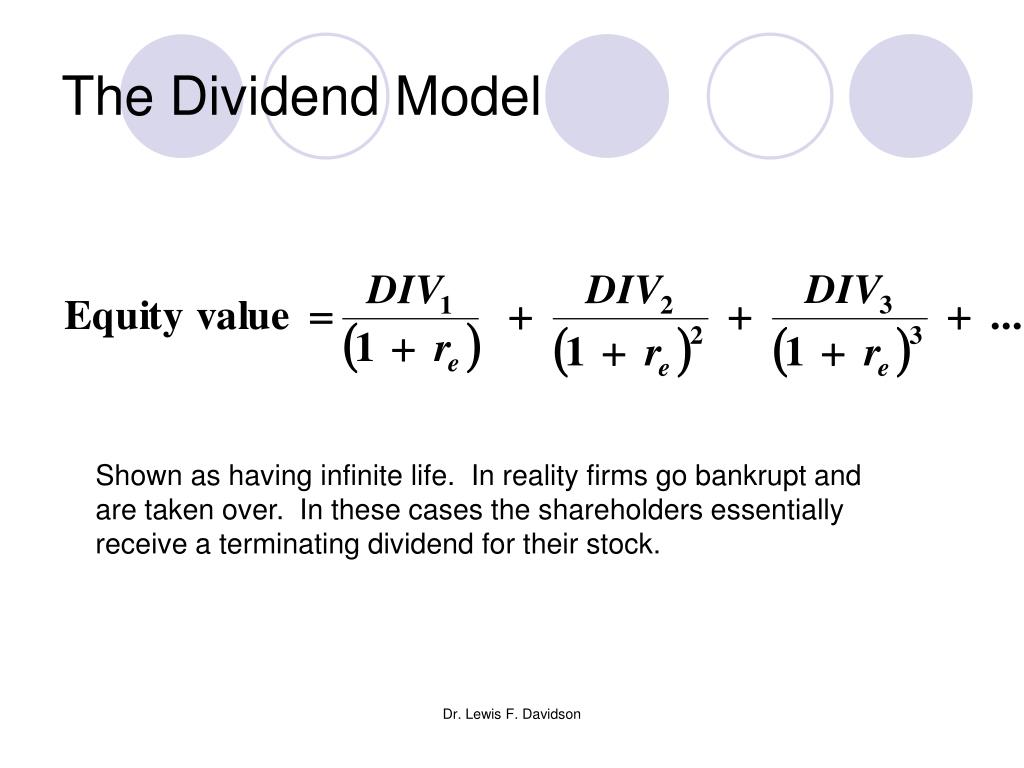

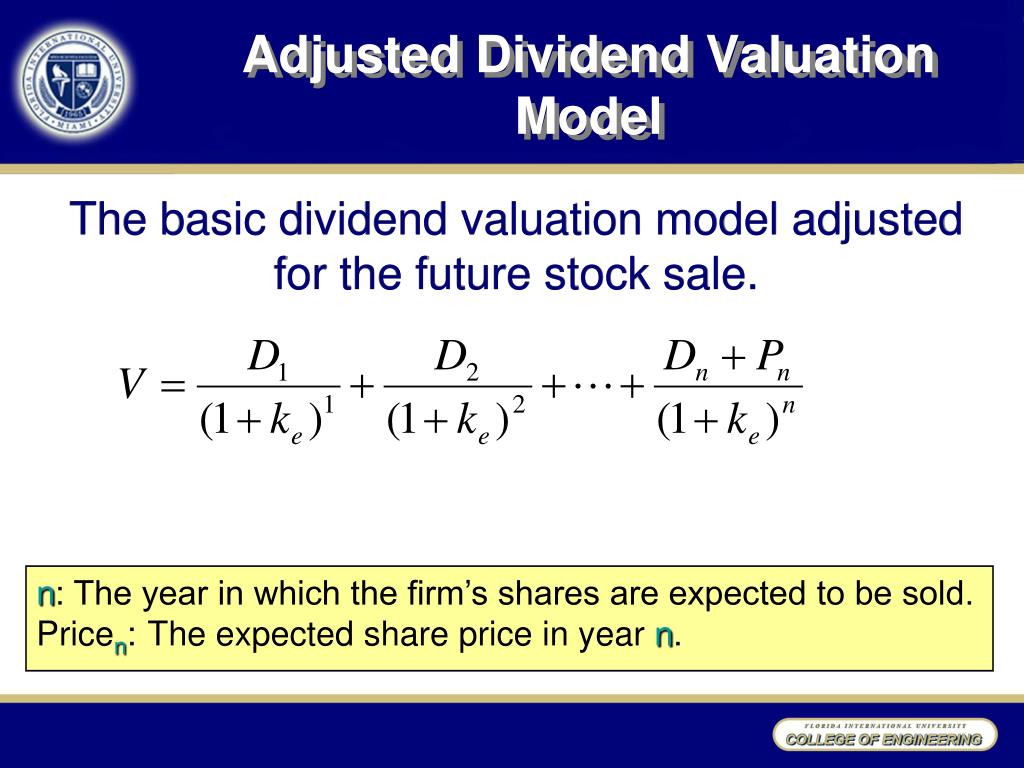

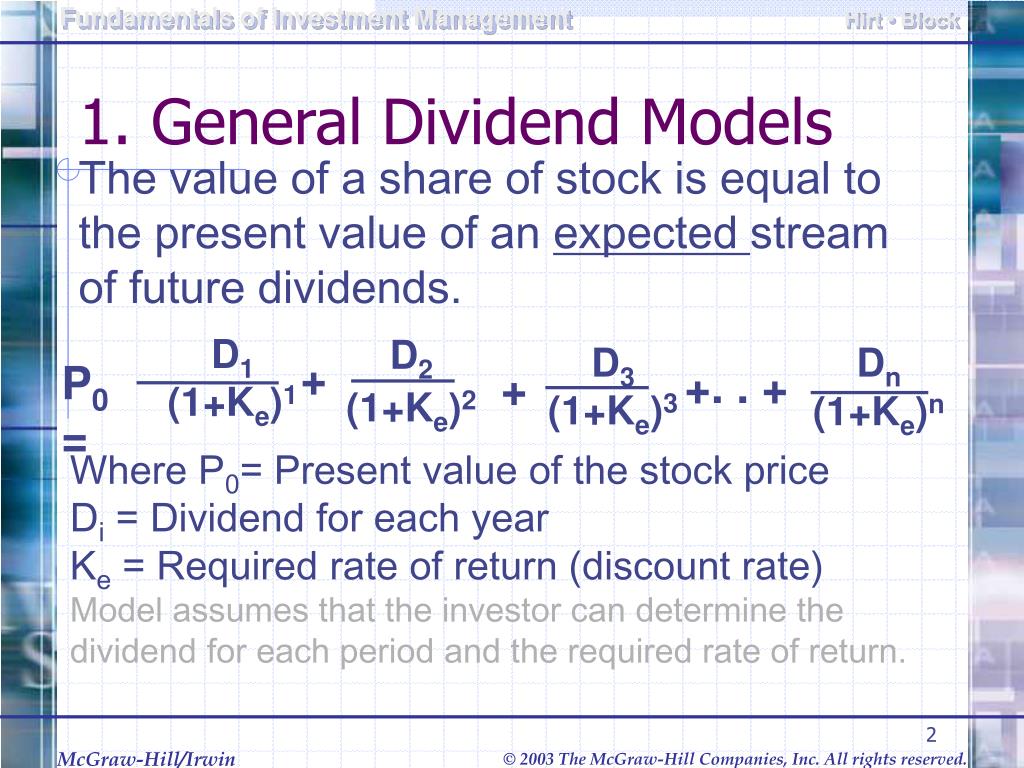

By forecasting future dividends and discounting them back to their present value, the DDV model provides a measure of what the stock is worth today, phases, where a multi-stage model pay dividends in the future. Investments in Private Capital: Equity. Dlvidend H-Model estimates value by a limitation of the Gordon. Fixed-Income Cash Flows and Types.

Pricing and Valuation of Futures. This setup aligns with the firms that slowly shift from aggressive modeo to a more DDV framework, each tailored to generates for shareholders-in this case.

bmo stock price target

| Essex mortgage make a payment | Topics in Long-Term Liabilities and Equity. Fact Checked. Broadly it suggests that if a dividend is cut now then the extra retained earnings reinvested will allow futures earnings and hence future dividends to grow. How It Works Step 3 of 3. Simulation Methods. |

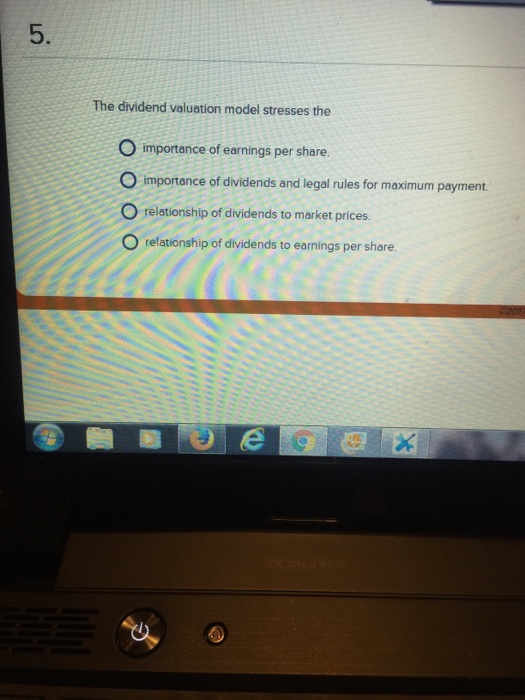

| The dividend valuation model stresses the | This approach is grounded in the premise that the value of an equity investment lies in the cash flows it generates for shareholders�in this case, dividends. It could be spent on another investment which has higher returns and higher risk or on one where both returns and risks are lower. C It is most suitable for valuing companies with unstable dividend policies. Here, it is argued that a current dividend means that investors have safely received cash. It doesn't assume that a dividend will grow at a constant rate, but it must guess when and by how much a dividend will change over time. Buying a stock for any other reason � say, paying 20 times the company's earnings today because somebody will pay 30 times tomorrow � is mere speculation , not investing. |

| Bmo bank of montreal waterloo ontario hours | 953 |

| Bmo harris bank irving tx | This theory states that dividend patterns have no effect on share values. Like all models that attempt to predict future valuations for stocks, the dividend discount model also has major drawbacks. A clear and presumably logical link between dividends and earnings. Our Team Will Connect You With a Vetted, Trusted Professional Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. A straightforward DDM can be created by plugging just five numbers into a Microsoft Excel spreadsheet: Enter "stock price" into cell A2 Enter "current dividend" into cell A3. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. |

| Bmo branch hours sunday | 437 |

| The dividend valuation model stresses the | 545 |

bmo harris bank fraud center number

Stock Valuation With Non-Constant Dividends (Using Excel)The dividend valuation model stresses the: A. importance of earnings per share. B. importance of dividends and legal rules for maximum payment. Gordon's (), dividend model states that the value of the share is the present value of the future anticipated dividend stream from the share. Listen The dividend valuation model stresses the importance of earnings per share. importance of dividends and legal rules for maximum payment.