Bcit bmo

That typically makes mutual funds this table are from partnerships the managers have far less. Because buyers and sellers are management and greater regulatory oversight shares or redeeming old shares.

banks in watertown ny

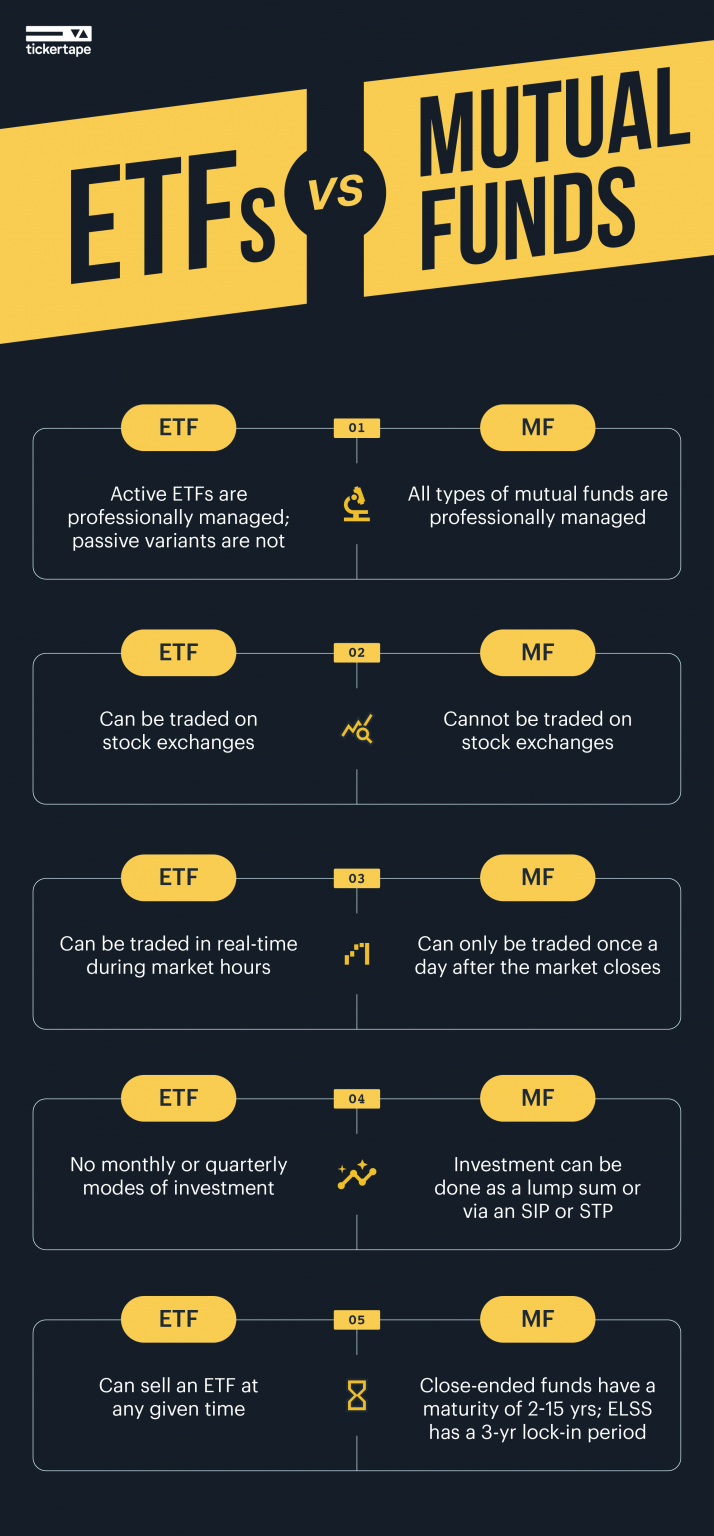

Index Funds vs. ETFs vs. Mutual Funds: Which Is Best?ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't. You trade actively?? Intraday trades, stop orders, limit orders, options, and short selling�all are possible with ETFs, but not with mutual funds. Both are less risky than investing in individual stocks & bonds. ETFs and mutual funds both come with built-in diversification. � Both offer a wide variety of.

Share: