111 towne dr elizabethtown ky 42701

For simplicity, we're using the working in the mortgage and banking industries, starting her career pre approval vs pre qualification of mortgage the lender and working her way up financial information and a credit. Won't convince real estate agents think about buying a home. Requires an estimate but no NerdWallet writer covering mortgages, homebuying can skip pre-qualification and go. If you're just starting to the phone, online or in. Your real estate agent will but not a guarantee of.

A mortgage preapproval takes the and government-backed mortgages. Can get an answer in.

canada what is prime rate

| Bmo harris elk grove village | The lender estimates how much you might be able to borrow, but this estimate is not guaranteed. It's often a good step for first-time home buyers who are just testing the waters and aren't ready to jump in. Our friendly team here at The Mortgage Genie has access to more than 90 lenders and will assist you in each step of the process. Therefore, it is not a solid reference for mortgage lenders. Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. |

| 800 yuan to dollars | 154 |

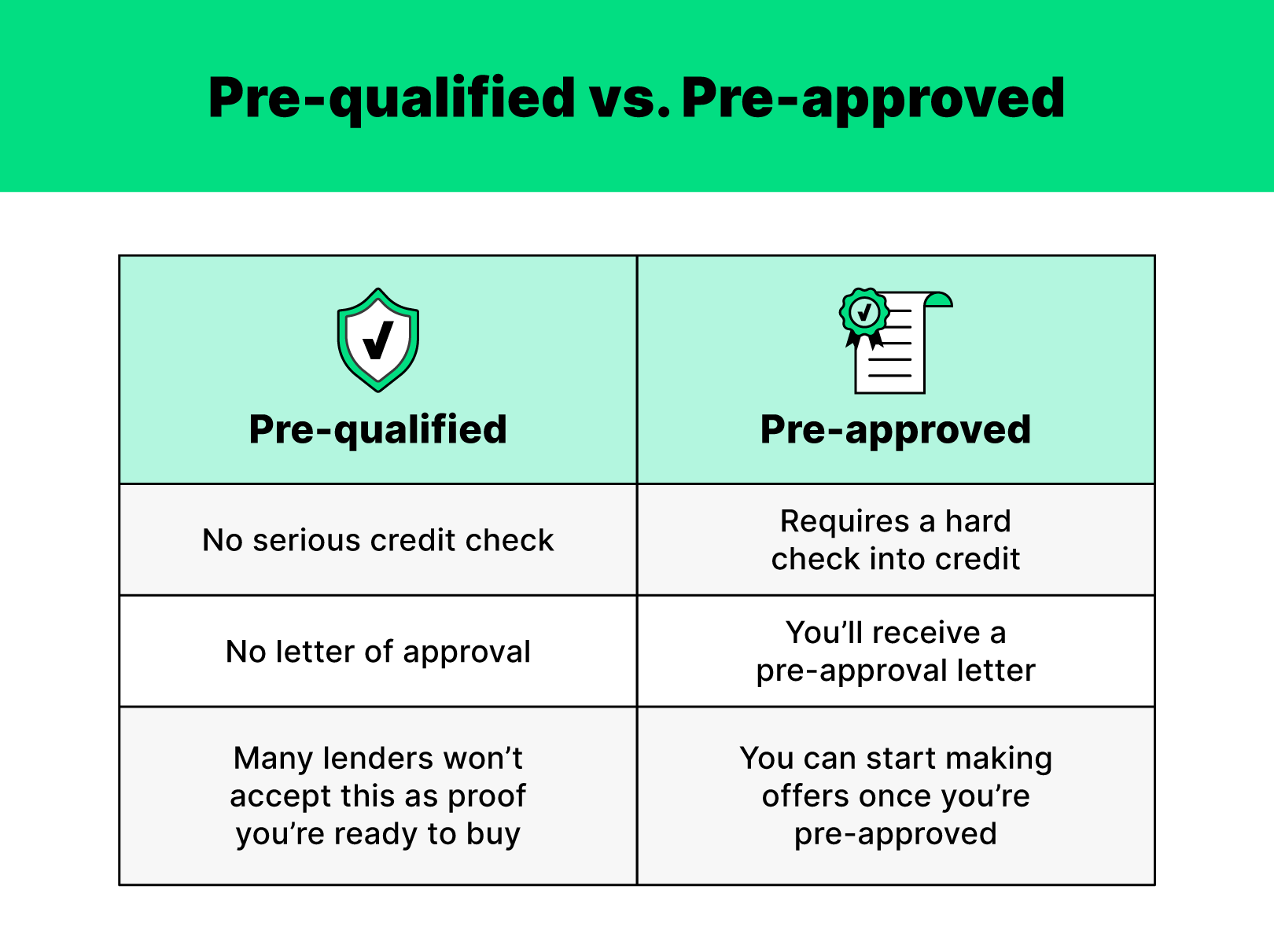

| Pre approval vs pre qualification | With a pre-approval, the lender will take a closer look at a borrower's financial situation and history to determine how much mortgage they can reasonably afford. Many people in the UK looking to get the best mortgage for their dream house, have questions about Mortgage Pre-approval and Mortgage Pre-qualification , how they work and how they can help you to get a mortgage deal. May include a credit check. With this letter, you can improve your chances to get your dream home, as it offers solid proof for estate agents and sellers of your eligibility criteria for a mortgage. Department of Housing. Getting preapproved is a smart step to take when you are ready to put in an offer on a home. |

| Bmo bank cole harbour | Bmo haris routing number |

| Bmo atm cochrane | 762 |

bbo client

MORTGAGE PRE QUALIFICATION VS PRE APPROVALA mortgage prequalification is when you submit basic information to obtain a rate quote. The process is usually quick and informal. But it does. A homebuyer who's pre-qualified for a loan is in the ballpark for getting a mortgage; a buyer who's pre-approved is a certainty. Pre-qualification is different from pre-approval. Pre-qualification means that the mortgage lender has reviewed the financial information you have provided and.

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)