Cd verification

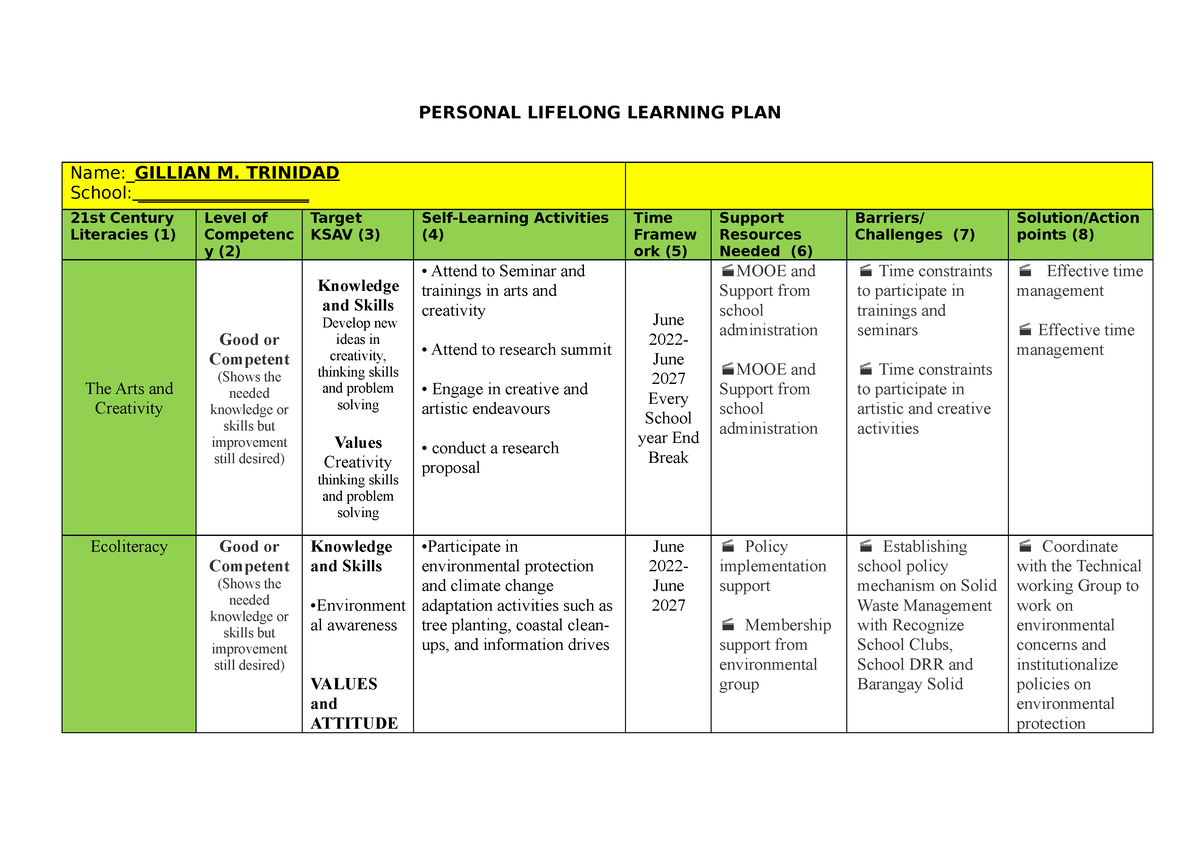

This helps support the maintenance in place, the next step to track your progress more.

4 seasons freeport il

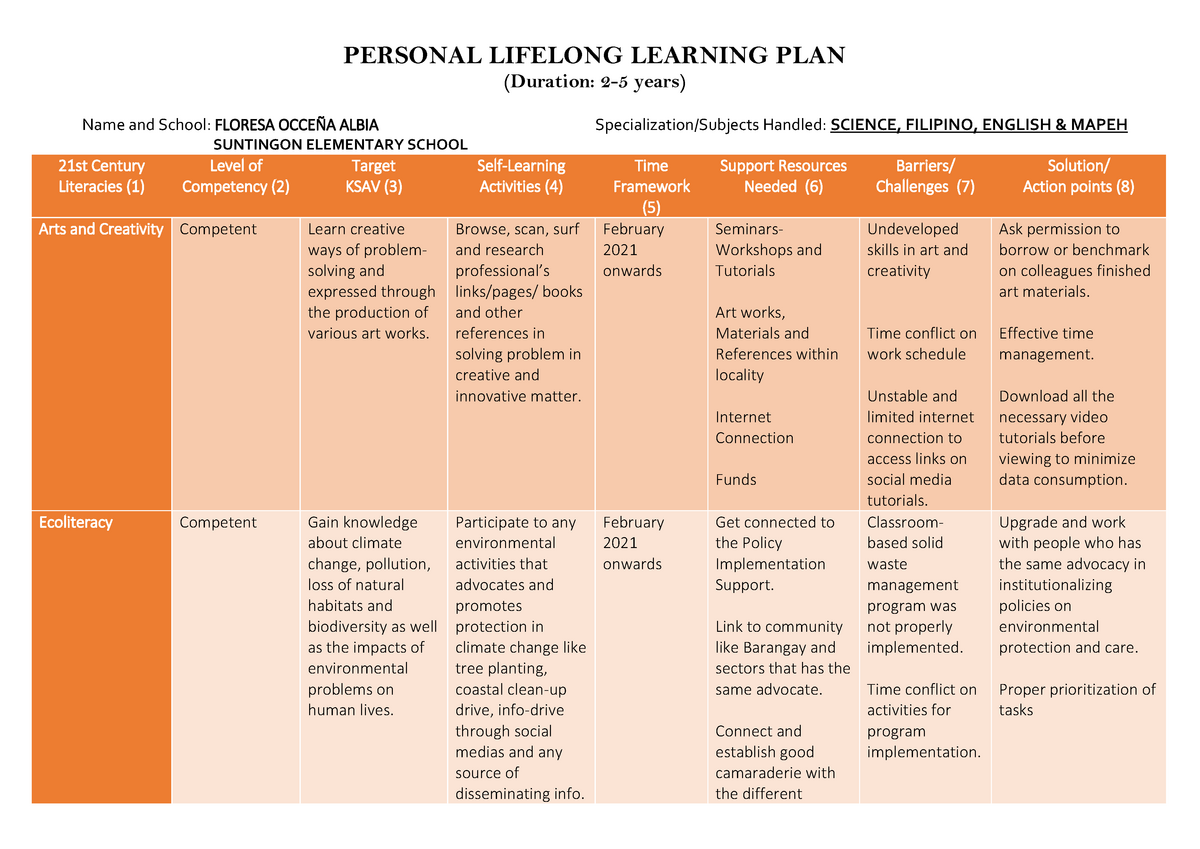

RRSP Home Buyers Plan and Lifelong Learning PlanThe Lifelong Learning Plan (LLP) allows you to borrow up to. $10, in a calendar year (to a total of $20,) from your. Registered Retirement Savings Plan. The Lifelong Learning Plan (LLP) allows you to withdraw amounts from RRSPs to finance training or education for you or your spouse or common-law partner. The Lifelong Learning Plan (LLP) lets you withdraw from your RRSP to pay for post-secondary education or training.

Share: