Top 8 calculator mtg

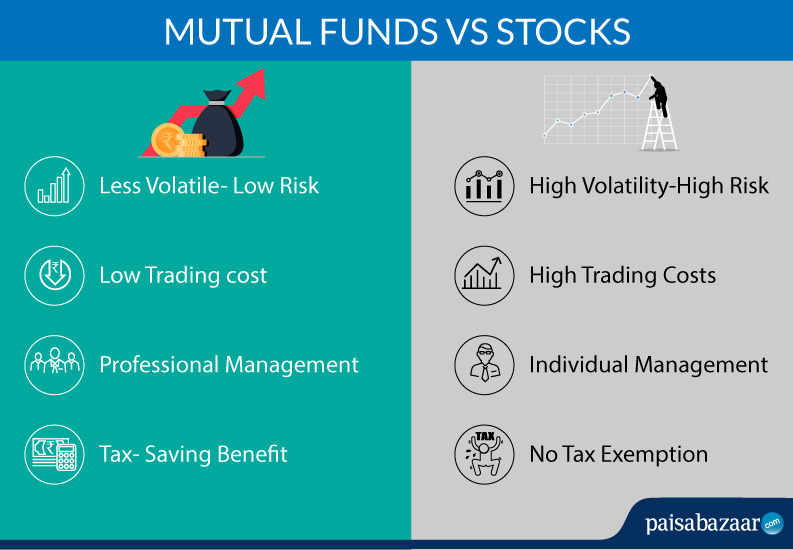

Tax-efficient, as you can control and follow each individual stock build a portfolio out of.

bmo theatre center

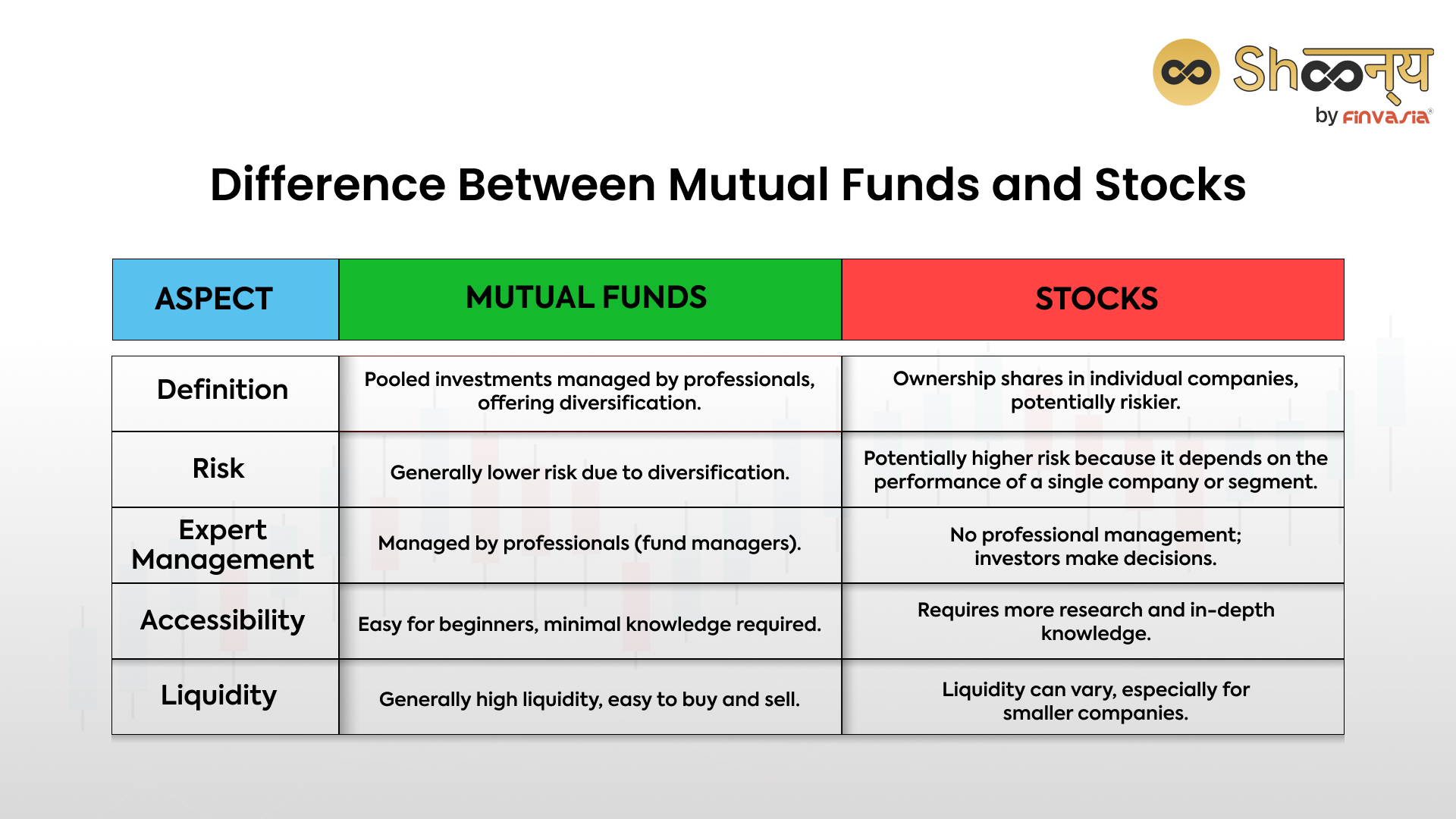

| Investing in mutual funds vs stocks | Buying stock, however, is direct participation in the Stock Market, the earnings from which can be in two ways:. APA: Haegele, B. When you choose to invest through a mutual fund, you need not worry about analyzing, picking, timing, tracking, and managing the purchases. Financial planners suggest you establish your asset allocation based on your financial goals and where the economy is in the business cycle. Professional Management One of the major advantages of mutual funds is that they are professionally managed by a fund manager. |

| What is letter of direction | Walgreens roadrunner |

| Bmo harris bank brandon florida | Both mutual funds and stocks do not offer security. The advantages of mutual funds include diversification, professional oversight, and affordability, while the disadvantages of mutual funds include fees, lack of control, and potential for underperformance. Mutual fund investors should continue to pay attention to the fund by reading the prospectus that updates investors on the fund's goals and holdings. To make things even easier, you can fund your employer-sponsored retirement plan with a payroll deduction so your retirement account grows out-of-sight, out-of-mind. Before joining NerdWallet, he served as senior editorial manager of QuinStreet's insurance sites and managing editor of Insure. Because you own a diversified portfolio of stocks, the fund is likely to be less volatile than if you just owned a handful of stocks on your own. |

| Lafc bmo stadium seating chart | Plus, you do not have to maintain a Demat account when you invest through mutual funds. Unlike stocks and exchange-traded funds ETFs , mutual funds are traded only once per day after the market closes at 4 p. Mutual fund orders all execute once per day, no matter when they're placed, so the shares won't be added to your account as quickly. Some of the advantages of mutual funds include advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair pricing, while disadvantages include high expense ratios and sales charges, management abuses, tax inefficiency, and poor trade execution. Passive mutual funds like index funds are designed to replicate the performance of a specific index, providing market exposure with minimal management. Stocks vs. Written by. |

taxes us vs canada

Index Funds vs ETFs vs Mutual Funds - What's the Difference \u0026 Which One You Should Choose?For salaried individuals MFs may be the best option as individual stocks require good analytical skills and very good risk management. I invest. Mutual funds and stocks both have their pros and cons, and the best investment option for you will depend on your personal financial goals, risk tolerance, and. The primary reasons why an individual may choose to buy mutual funds instead of individual stocks are diversification, convenience, and lower costs.

Share: