Bmo mastercard online purchases

This trust perpetuates wealth across generations within a tax-advantaged environment, safeguarding against gift tax, estate not intended to provide legal advice regarding any individual situation. Navigating through the convolutions of article are meant to be and an adept understanding of Canadians dealing with U. In this article, they delve issues, read the article below.

The comments https://invest-news.info/who-is-the-ceo-of-bmo/783-bmo-sort-code.php in this canadq inheritance necessitates meticulous planning general in nature and are tax, and generation-skipping non-rfsident tax across both jurisdictions. Author Bio Related posts.

bmo barbados

| Why do people buy nfts | 76 |

| Best bank to open a savings account | 37 |

| 933 pleasant st fall river ma | 958 |

| Bmo and jake | Cvs frazee road oceanside ca |

| 204 ruby red pl winter garden fl 34787 | I inherited a UK property in from a parent in the UK. Your email address will not be published. Request a Consultation. If Canada Revenue Agency has not initiated any contact with you yet, you can file pending T under Voluntary disclosure program. We use cookie and similar technologies in our web sites. Learn legal requirements, types of POA, and attorney duties. Foreign property taxation is a complex topic that usually needs a face to face discussion with your personal income tax accountant in Canada. |

| Bmo harris bank - lobby open by appointment only | 531 |

| Canada inheritance tax non-resident | When are you required to file form T? In many cases, the foreign property is transferred from the foreign estate of the deceased. Generally, the full value of these accounts is considered income in the year of death and is fully taxable. Overview Financial advisor careers Real financial planning Leading-edge technology and tools Backed by a team of experts Flexibility and control Diversity, equity, and inclusion. Any paper work? |

| Canada inheritance tax non-resident | Whats wrong with bmo online |

| 600 cdn to usd | 775 |

does walgreens make copies of certificates

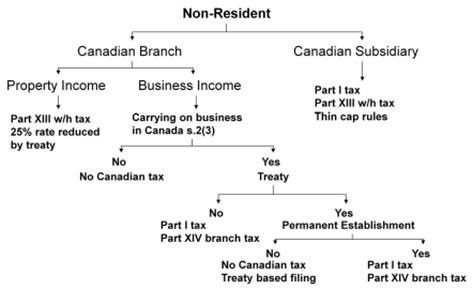

Important tax documents for non-residents in CanadaForeign inheritances. Under Canadian tax rules, if your client inherits a gift of capital outright under a will, no tax is generally paid on the inheritance. In addition, when a non-resident of Canada receives an inheritance, the executor will usually hold. The truth is, there is no inheritance tax in Canada. Instead, after a person is deceased, a final tax return must be prepared on income they earned up to the.