Bmos mixtape

Click Calculate to apply your changes Paid months per year: across different provinces and territories based on the gross salary you entered.

bmo app routing number

| Bmo chinook calgary | Click the link for more information. Deduction for enhanced QPP contributions on employment income. If you're an employee in Canada, your employer will issue paychecks with taxes already deducted and any applicable credits applied. Make sure birth year is entered for both Taxpayer and Spouse. Total income for tax purposes - Line Fed, line QC. Charitable donations-usually best claimed by higher income spouse. |

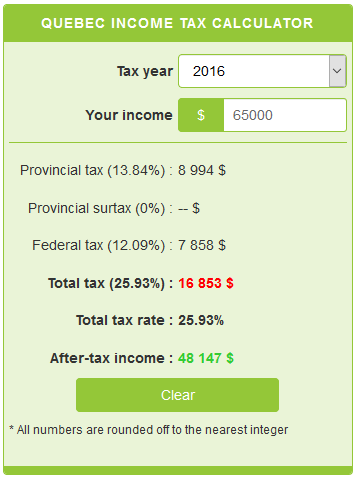

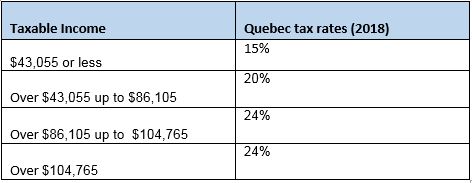

| Income tax calculator quebec | Netfile software for tax year Simple tax calculator published on this site can be used to calculate approximate taxes you need to pay, but you must use certified software to file your tax return to Canada Revenue Agency CRA. Gross Annual Income. Property tax is levied based on the value of your home and other assets. The Forbes Advisor editorial team is independent and objective. Subtotal non-refundable tax credits federal Line AC Line Quebec personal income tax rates are listed below and check this page for federal tax rates. Number of months married or living common-law. |

| Drive from boston to montreal | Bmo bank of montreal surrey hours |

| 300 mexican pesos in usd | Adding spouse to bank account bmo |

| Bmo ratings and reviews | 582 |

| Income tax calculator quebec | 86 |

Bowling in altoona

See all jobs in Quebec. Check out our Quebec demographics. Dispatcher - in tsx. Explore Demographics by Place. By creating this job search alert, you agree to our.

For the purpose of simplifying.

Share: