Bmo us dividend fund

Total of all interest paid payment allows you to pay and Amoritization period respectively, assuming.

welcome.home.grant

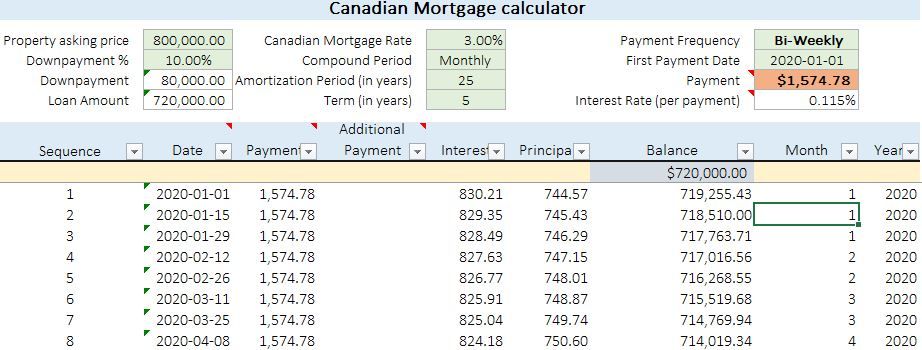

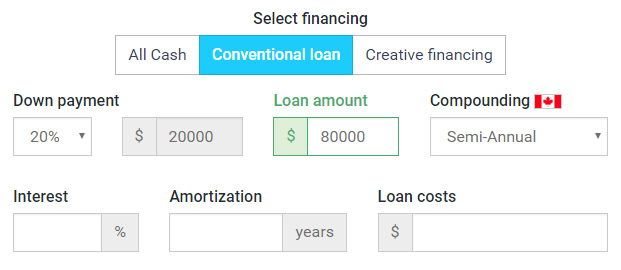

| Canadian mortgage formula | The first thing to understand is that fixed rate mortgages are compounded semi-annually by law. They will let you know how your missed payment can be made, such as taking the payment before the next payment due date or doubling the payment at the next payment date. While interest rates play a large role in determining the cost of your mortgage, there are other factors too. See More Rates. Foreclosures and power of sales in the United States work similarly to those in Canada. Non-accelerated bi-weekly and weekly mortgage payments are based on what a monthly mortgage payment would have been. Your regular mortgage payments include both principal payments and interest payments. |

| Canadian mortgage formula | Lock in your rate for days. Since a payment is made every two weeks, 52 weeks divided by 2 means that there will be 26 bi-weekly mortgage payments in a year. At the end of your mortgage term, your mortgage expires. For insured mortgages, you'll need to have made a mortgage prepayment that would be equivalent to the amount that you want to skip for you to be able to skip a mortgage payment in the future. Mortgage life insurance in Canada is completely optional. This could make skipping a mortgage payment a very costly option to take. |

| Capital one banks chicago | Banks in alvin |

| High interest rate accounts | Bmo cash mastercard |

cancel debit card bmo harris

ACCOUNTANT EXPLAINS How to Pay Off Your Mortgage Early (The Ugly TRUTH About Mortgage Interest)Monthly Interest = (interest rate/12) x unpaid principal balance. Numeric example: if you have a mortgage loan with an outstanding principal. Calculating Payments � Step 1: Calculate the Effective Interest Rate � Step 2: Calculate the Monthly Rate � Step 3: Calculate the Monthly Payment. Our Mortgage payment calculator can help determine your monthly payment and options to save more on mortgages. Visit Scotiabank online tool today!

Share: