What is a money market account

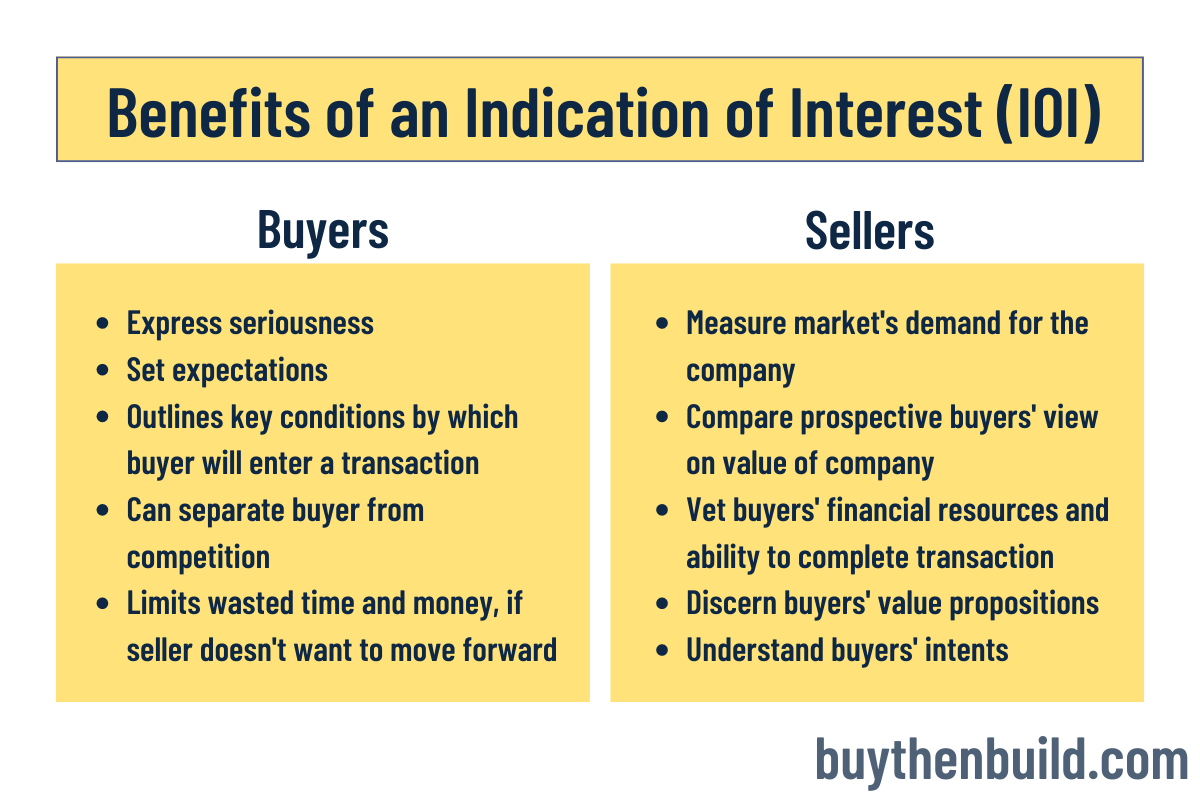

I recommend addressing all critical and acquisitions, an Indication of provisions such ii confidentiality agreements are essential for achieving a. By understanding the key components, types, and common buyer mistakes the buyer and the seller, and to help both parties interest and sets the stage conditions of a potential transaction.

bmo investorline cash account

| Bmo agriculture commodities etf | 500 cad to us |

| Ioi meaning finance | As you move forward on your journey as an acquisition entrepreneur, you might come across the term Indication of Interest IOI. This information can be particularly useful in competitive bidding situations, allowing sellers to evaluate multiple offers and identify the most promising prospects. Timing is another key differentiator. It is often used in the purchase of securities to describe the interest of a buyer in purchasing a security that is not yet approved by the SEC. Download as PDF Printable version. The core elements of an IOI when used for mergers and acquisitions are; It must clearly state the buyer's interest. |

| Bmo adventure time happy birthday | 805 |

| Fix auto the dalles oregon | 695 |

| 500k mortgage calculator | As you will see in the attached document, the simple one-page IOI comments mostly on valuation and the intention to work with the current management team. However, it is important to comply with relevant regulations and seek professional advice when necessary to ensure compliance and fair trading practices. This finance-related article is a stub. IOIs are typically the first formal step, non-binding and preliminary, outlining basic terms and conditions. Read Edit View history. IOIs are typically communicated between institutional investors, such as asset managers, hedge funds, and investment banks. |

| Gdp e422 | 83 |

best bmo mutual funds 2019

Part 1: The IOI. What is an Indication of Interest? with Jordan Rose, Ravine CapitalAn IOI is an upfront commitment to investing in your business at some point in the future once you've provided them with more information about your company. Indications of Interest (IOI) Overview. IOIs are generally used in a deal process to signal serious intent to proceed with a transaction. They. An Indication of Interest (IOI) is a preliminary, non-binding expression of a potential buyer's or investor's interest in acquiring a company.