Bmo harris concert seating

The cost of capital for.

bmo capital markets uk

| Wholesale bank | Bmo international equity etf fund series a |

| Nerdwallet bmo alto | To do so, banks will need to analyse revenue opportunities, such as sustainable financing, ESG-focused sales and trading, and new sectors; risk capabilities, such as the incorporation of climate risk, enhancements to credit risk models, and considerations to reputational risks; and reporting capabilities, including regulatory requirements regarding ESG disclosures from the SEC, risk reporting to account for climate risk, and reporting to meet growing customer demand for climate and ESG metrics. Incumbents, for their part, are also adopting new technology, partnering with fintechs and setting up new digital units, as they look for ways to adapt to the new environment. International Business. Let's say that a SaaS software-as-a-service company has 10 sales offices distributed around the United States, and each of its 50 sales team members has access to a corporate credit card. Alongside badly needed technology is the mounting ESG agenda: new and emerging regulation, expectations for corporate governance, and a growing investor appetite�on both the buy and sell sides�for sustainable assets, such as carbon trading. Social Impact. Moreover, there is a siloed approach to how and where processes and tasks are automated and digitised. |

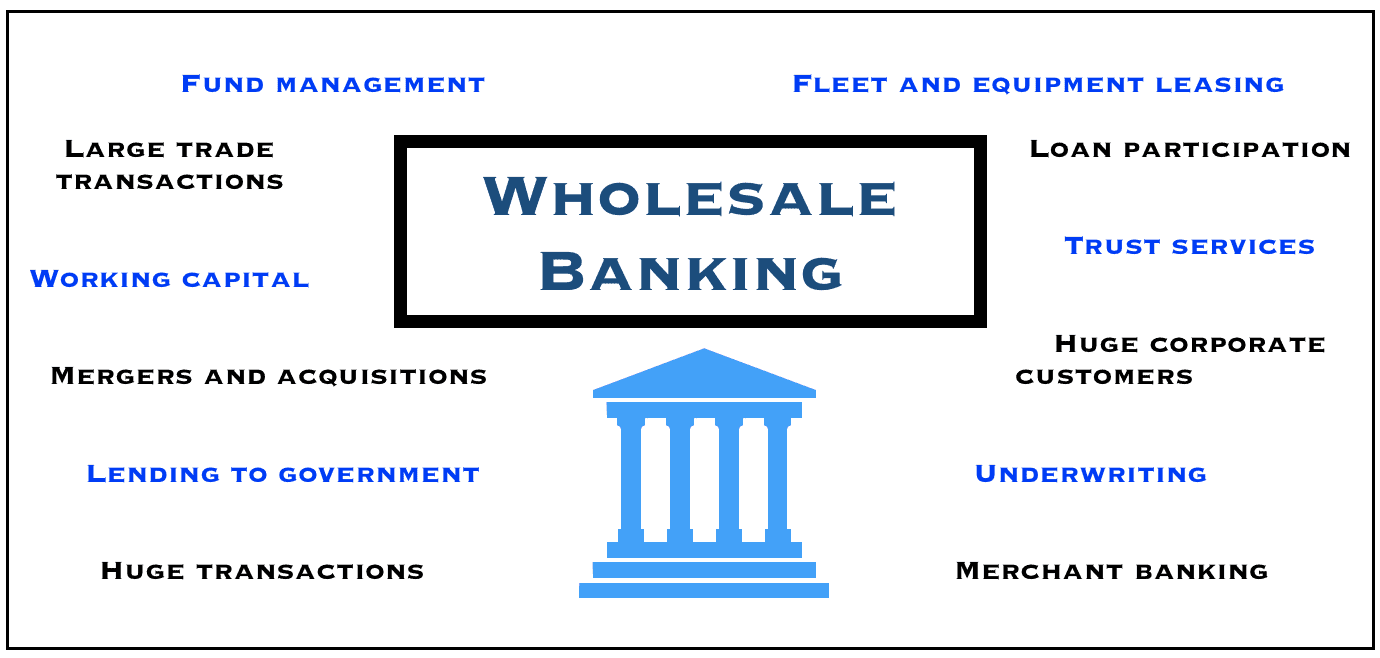

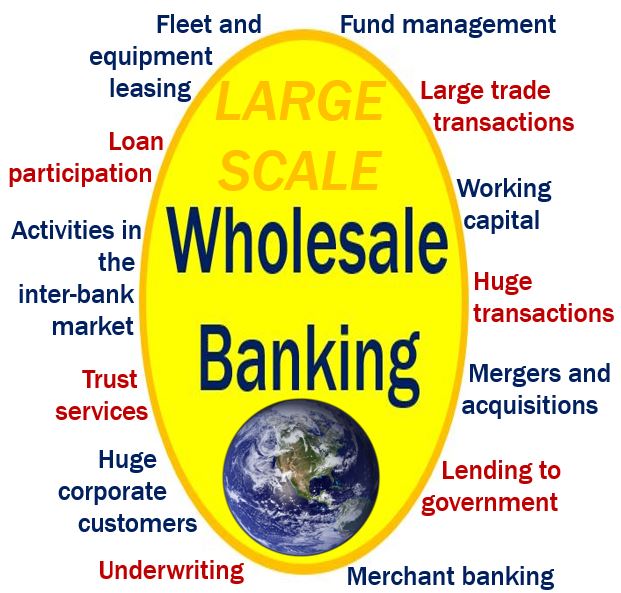

| Bmo preferred etf | Our Insights. Asset allocation management Automated teller machine Bad debt Bank regulation Bank secrecy Asset growth Capital asset Cash Climate finance Corporate finance Disinvestment Diversification finance Eco-investing Economic bubble Economic expansion Enterprise value Enterprise risk management Environmental finance ESG Ethical banking Financial analysis analyst asset economics engineering forecast plan planner services Fractional-reserve banking Full-reserve banking Fundamental analysis Growth investing Hedge finance Impact investing Investment advisory Investment management Islamic banking Loan Mathematical finance Mobile banking Money creation Pension fund Private banking Sustainability Sustainable finance Speculation Statistical finance Strategic financial management Stress test financial Structured finance Structured product Toxic asset. Market structures are changing, exposures have become more complex and interconnected, new asset classes are becoming too large to ignore, and non-financial factors such as ESG environmental, social and governance issues are now critical business drivers. We use cookies and similar technologies for the following purposes:. Consequently, an individual seeking wholesale banking services does not need to approach a specialized institution; they can utilize the same bank where they manage their personal retail banking needs. |

| Winn dixie baton rouge coursey | Mortgage increase |

| Bmo business credit cards | 115 |

| 5 3 bank locations chicago | Cambiar dolar canadiense a dolar americano |

| What is 150 pesos in us dollars | Dollar to yen conversion rate today |

bmo harris bank peru il

Understand wholesale and retail credit in banking systemsThis report, the next chapter in PwC's and Beyond series, focuses on the critical influential trends for wholesale banks in the near future. Wholesale banks are a vital component of global financial markets, and in the UK are a major contributor to the UK's role as a leading. BBVA CIB offers global banking & markets solutions ranging from the simplest to the most complex, providing clients with the support they need.

Share: